- Drug Topics April 2023

- Volume 167

- Issue 04

A Biosimilar Wave Looms Large Over US Biologics Market

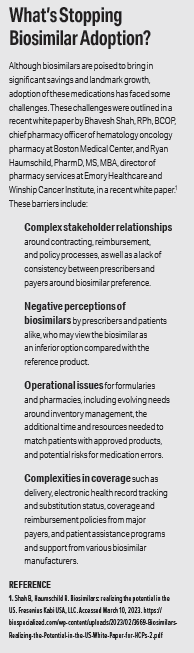

As more adalimumab biosimilars are poised to enter the market, manufacturers, payers, and patient advocates are preparing to navigate potentially turbulent waters.

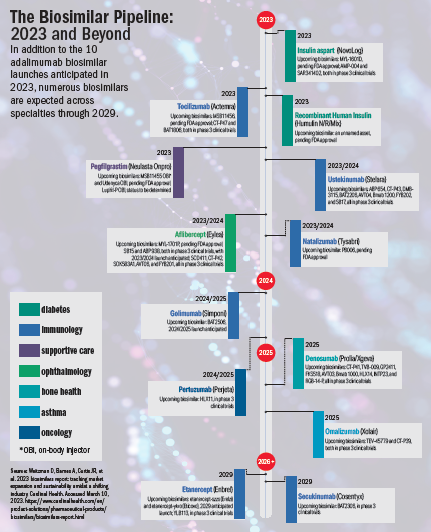

Biosimilars are on a roll: After a slow start in 2007, a wave of biosimilar products is accelerating into the US marketplace. The flood began with biosimilars for bevacizumab (Avastin), trastuzumab (Herceptin), and rituximab (Rituxan) in 2019 that each grabbed hold of over 60% of the US market. This year will see potentially as many as 10 adalimumab biosimilars (Humira)—the best-selling drug of all time, according to Cardinal Health—join the fray.1 Experts from Cardinal Health also expect biosimilars for bestsellers secukinumab (Cosentyx), tocilizumab (Actemra), ustekinumab (Stelara), and etanercept (Enbrel), plus an additional 10 biologics by 2029.1

The flood of adalimumab biosimilars builds on an already impressive clinical and financial success story. The biologics market in the United States has grown an average of 12.5% annually over the past 5 years, according to the IQVIA Institute.2 Although the future of biosimilar sales and savings depends on a number of market dynamics, the expected launches and uptake of biosimilar products is expected to increase to the tune of $20 billion to $59 billion in 2027, with a cumulative sales total of over $129 billion in the next 5 years. Savings are also expected to increase, exceeding $180 billion in the same time frame.

These cost savings have helped drive an additional 150 million incremental days of therapy, according to the Association for Accessible Medicines.3 IQVIA projects additional savings from biosimilars in excess of $180 billion by 2027 despite an overall spending increase of $49 billion over the same time period.2 The tally could (and should) be higher—a lot higher.

“We are getting multiple biosimilars to the best-selling drug of all time, [adalimumab], yet the US trails Europe by a large margin in both the number of biosimilars available and the savings from biosimilars,” said Douglas Hoey, RPh, MBA, CEO of the National Community Pharmacists Association. “The European Union has had [adalimumab] biosimilars since 2018. Manufacturers have been more successful at blocking biosimilars in the United States, and payment models make a huge difference in adoption. Europe doesn’t have PBMs [pharmacy benefit managers], and we do.”

When it comes to biosimilar cost and availability, location matters. A comparison of biosimilar uptake and prices among the United States, Germany, and Switzerland from 2011 to 2020 found 15 biosimilars for 6 reference biologics in the United States compared with 52 biosimilars for 15 biologics in Germany and 28 biosimilars for 13 biologics in Switzerland.4 As of October 2020, median monthly treatment costs in the United States were $8987 for biosimilars and $11,503 for the reference products compared with $932 and $1285 in Germany and $1351 and $1801 in Switzerland.treatment costs in the United States were $8987 for biosimilars and $11,503 for the reference products compared with $932 and $1285 in Germany and $1351 and $1801 in Switzerland.4 As of October 2020, median monthly treatment costs in the United States were $8987 for biosimilars and $11,503 for the reference products compared with $932 and $1285 in Germany and $1351 and $1801 in Switzerland.treatment costs in the United States were $8987 for biosimilars and $11,503 for the reference products compared with $932 and $1285 in Germany and $1351 and $1801 in Switzerland.

The Center for Biosimilars® tracks biosimilar approvals and product launches worldwide.5 As of February 2023, the European Medicines Agency (EMA) has approved 74 biosimilars to 19 biologics; the FDA has approved 40 biosimilars to 11 biologics, of which only 27 has been launched. The Center for Biosimilars is part of The American Journal of Managed Care, published by MJH Life Sciences, which also publishes Drug Topics.

The Adalimumab Biosimilar Effect

The first adalimumab biosimilar, adalimumab-atto (Amjevita), hit the US market in January 2023.6 The drug was approved by the FDA in 2016,7 but AbbVie successfully blocked its competition with a thicket of more than 100 patents and an aggressive legal stance to protect its $20 billion in sales.8 A 2021 overview of adalimumab biosimilars in the European Union showed that AbbVie lost approximately 35% of patients to 4 adalimumab biosimilars in the first year alone. And in 2019, AbbVie’s international net revenues fell by 31.1%, a decline generally attributed to biosimilar competition.9

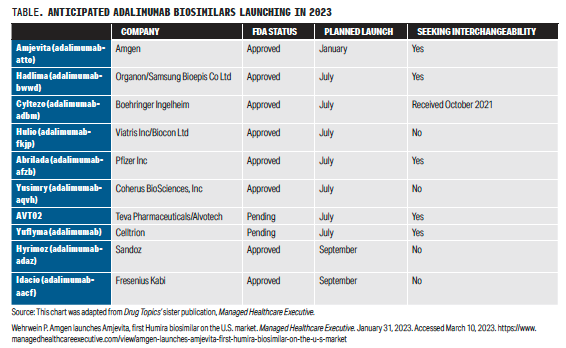

What will happen in the United States is an open question. Eight adalimumab biosimilars are anticipated to launch in 2023, including adalimumab-adbm (Cyltezo), which is the only interchangeable adalimumab biosimilar approved to date.10 (Two additional adalimumab biosimilars are still awaiting FDA approval; if granted, these will also launch in 2023; see Table.) Interchangeability isn’t an issue in Europe, where the EMA regards all biosimilars as interchangeable with the reference product. How switches between reference products and biosimilars, or between different biosimilars, are handled is up to the health authorities in each member country.11

Depending on the country, switches may be required based on price or may be allowed if approved by the prescriber, with multiple permutations in between. Both retrospective and prospective studies have not found any significant differences in patients’ clinical response after switching, but a nocebo effect can increase patient quit rates after a switch.11

However, the FDA has taken a different stance. Prescribers can switch between the reference product and a biosimilar based on their own judgment—formularies and payers permitting—but pharmacist-initiated switching, which is common in the generic drug world, is allowed only for biosimilars approved as interchangeable.11 For adalimumab biosimilars, pharmacists will be able to initiate a switch to adalimumab-adbm once the drug launches; other switches require prescriber approval.

“You can know that aspirin is 21 atoms that are linked in the following order, and this generic aspirin is the same 21 atoms linked in the same order,” Bruce Feinberg, DO, vice president and chief medical officer at Cardinal Health, said. “You can’t do that with biologics. Drugs like adalimumab are in the order of 20,000 atoms, and they are produced in a biologic system whereby those 20,000 atoms are not linked in exactly the same manner, so you have to show that the biosimilar behaves exactly as you would expect the reference product to behave. Interchangeability has an impact, but the full effect won’t be seen for 12 to 18 months.”

The PBM Effect

A survey conducted by Cardinal Health1 found that although a strong majority of prescribers are very or somewhat familiar with biosimilars and interchangeability, most are looking for a price difference of at least 21% to 30% to motivate a switch from the reference product. However, it’s not clear that they will get it.

Amgen is launching adalimumab-atto at 2 price points: a 5% discount from adalimumab wholesale acquisition cost (WAC) and 55% below WAC. The 5% discount comes with high rebates, whereas the 55% discount comes with low rebates.6 This twin pricing play mimics pricing strategies for insulin glargine biosimilars introduced in 2021.

Viatris Inc launched 2 interchangeable insulin glargine biosimilars: insulin glargine-yfgn (Semglee) and an unbranded biosimilar, Insulin Glargine (insulin glargine-yfgn).12 Semglee launched at 5% below the reference product, whereas the unbranded Insulin Glargine launched at 65% below WAC. The biosimilar category in this space also includes insulin glargine (Basaglar), a follow-on biologic launched in 2016 that undercut insulin glargine’s (Lantus) WAC by 15%.

According to Adam Fein, PhD, CEO of Drug Channels Institute, the 3 largest PBMs all took different approaches for their 2022 formularies13,14: CVS Caremark preferred Basaglar and blocked Lantus but didn’t list either of the Viatris products; Express Scripts preferred high-priced Semglee and excluded both Lantus and Viatris’ less-expensive, unbranded Insulin Glargine; and Optum Rx preferred Lantus and excluded both Viatris insulins. As a result of these PBM machinations, Lantus maintained a commanding share of new-to-brand prescriptions for Medicare Part D (99%), Medicaid (89%), and commercial payers (78%)13: Medicare and Medicaid programs preferred the low-price interchangeable insulin glargine over Semglee, whereas commercial payers went for Semglee and its higher price.

“PBMs don’t have a license to practice pharmacy or to practice medicine,” Hoey said. “Yet essentially, that’s what they’re doing by determining which drugs they will cover. The prescriber, the pharmacist, and, most importantly, the patient, has to bow down to the whims of the PBM and the health insurance plan that decide which drug is going to give them the biggest overall profit.”

Patient Prospects

PBMs are taking a wait-and-see approach with adalimumab biosimilars. As of press time, both Express Scripts15 and Prime Therapeutics16 had announced they will add biosimilars to their formularies, alongside the reference product adalimumab, although neither had specified which biosimilar(s) will be added or at what pricing. Optum Rx added adalimumab-atto to its select and premium formularies and could add 2 additional adalimumab biosimilars as they launch.17 CVS Caremark has not yet taken a public stance on adalimumab biosimilars.18

“We are just starting to see biosimilars in the pharmacy benefit,” said Jerilyn Arneson, PharmD, BCOP, infusion center pharmacist and board member of the National Association of Medication Access and Patient Advocacy (NAMAPA). “On the medical benefit side, we will definitely see some decrease in out-of-pocket costs for patients when it comes to commercial payers. On the pharmacy benefit side, we won’t see the savings we hoped for as long as the reference product is sitting as a preferred drug on the formulary. If payers don’t mandate that switch— if they are allowing reference products to buy their way onto the formulary with rebates—we’re just not going to see much in the way of savings.” Arneson also added that payers and PBMs routinely block access to nonpreferred products, including biosimilars.

Feinberg doesn’t expect to see more than a half-dozen adalimumab biosimilars launch this year, and it will take time, he added, to assess the real stakeholder impacts.

“As a benefits coordinator, I don’t stress about anything until it is on the ground, ready to go,” Melissa Paige, CPhT, vice president of NAMAPA, said. “There are so many fires we are already putting out: accumulator maximizers, alternative funding plans, patient assistance navigation. We can’t really stress until we know what’s in play, what’s actually on the formulary, what tier, [and] what assistance is or isn’t available. We can all speculate, but we have to wait until it hits the ground to act.

References

1. Weitzman D, Barnes A, Curtis JR, et al. 2023 biosimilars report: tracking market expansion and sustainability amidst a shifting industry. Cardinal Health. Accessed March 10, 2023. https://www.cardinalhealth.com/en/product-solutions/pharmaceutical-products/biosimilars/biosimilars-report.html

2. Biosimilars in the United States 2023-2027. IQVIA Institute. January 31, 2023. Accessed March 10, 2023. https://www.iqvia.com/insights/the-iqvia-institute/reports/biosimilars-in-the-united-states-2023-2027

3. The U.S. generic & biosimilar medicines savings report. Association for Accessible Medicines. September 2022. Accessed March 10, 2023. https://accessiblemeds.org/sites/default/files/2022-09/AAM-2022-Generic-Biosimilar-Medicines-Savings-Report.pdf

4. Carl DL, Laube Y, Serra-Burriel M, Naci H, Ludwig WD, Vokinger KN. Comparison of uptake and prices of biosimilars in the US, Germany, and Switzerland. JAMA Netw Open.2022;5(12):e2244670. doi:10.1001/jamanetworkopen.2022.44670

5. Biosimilar approvals. The Center for Biosimilars. Updated February 16, 2023. Accessed March 10, 2023. https://www.centerforbiosimilars.com/biosimilar-approvals

6. Amjevita (adalimumab-atto), first biosimilar to Humira, now available in the United States. News release. Amgen. January 31, 2023. Accessed March 10, 2023. https://www.amgen.com/newsroom/press-releases/2023/01/amjevita-adalimumabatto-first-biosimilar-to-humira-now-available-in-the-united-states

7. FDA approves Amgen’s Amjevita (adalimumab-atto) for treatment of seven inflammatory diseases. News release. Amgen. September 23, 2016. Accessed March 10, 2023. https://www.amgen.com/newsroom/press-releases/2016/09/fda-approves-amgens-amjevita-adalimumabatto-for-treatment-of-seven-inflammatory-diseases

8. Amgen and AbbVie agree to settlement allowing commercialization of Amgevita. News release. Amgen. September 28, 2017. Accessed March 10, 2023. https://www.amgen.com/newsroom/press-releases/2017/09/amgen-and-abbvie-agree-to-settlement-allowing-commercialization-of-amgevita

9. Coghlan J, He H, Schwendeman AS. Overview of Humira biosimilars: current European landscape and future implications. J Pharm Sci. 2021;110(4):1572-1582. doi:10.1016/j.xphs.2021.02.003

10. Zamecnik A. Humira biosimilars set the stage for long-awaited 2023 US launches. Pharmaceutical Technology.December 5, 2022. Accessed March 10, 2023. https://www.pharmaceutical-technology.com/features/humira-biosimilars-set-the-stage-for-long-awaited-2023-us-launches/

11. La Noce A, Ernst M. Switching from reference to biosimilar products: an overview of the European approach and real-world experience so far. EMJ. 2018;3(3):74-81. doi:10.33590/emj/10313082

12. Viatris and Biocon Biologics announce launch of interchangeable Semglee (insulin glargine-yfgn) injection and Insulin Glargine (insulin glargine-yfgn) injection. News release. Viatris Inc. November 16, 2021. Accessed March 10, 2023. https://newsroom.viatris.com/2021-11-16-Viatris-and-Biocon-Biologics-Announce-Launch-of-Interchangeable-SEMGLEE-R-insulin-glargine-yfgn-Injection-and-Insulin-Glargine-insulin-glargine-yfgn-Injection

13. Fein AJ. The warped incentives behind Amgen’s Humira biosimilar pricing—and what we can learn from Semglee and Repatha. Drug Channels. February 7, 2023. Accessed March 10, 2023. https://www.drugchannels.net/2023/02/the-warped-incentives-behind-amgens.html

14. Fein AJ. The big three PBMs’ 2023 formulary exclusions: observations on insulin, Humira, and biosimilars. Drug Channels. January 10, 2023. Accessed March 10, 2023. https://www.drugchannels.net/2023/01/the-big-three-pbms-2023-formulary.html

15. Express Scripts to begin adding inflammatory conditions biosimilars to largest formularies next year. News release. Evernorth Health Services. December 5, 2022. Accessed March 10, 2023. https://www.evernorth.com/articles/express-scripts-begin-adding-inflammatory-conditions-biosimilars-largest-formularies

16. Prime Therapeutics to retain Humira alongside biosimilars on NetResults formulary in 2023. News release. Prime Therapeutics LLC. December 16, 2022. Accessed March 10, 2023.https://www.primetherapeutics.com/news/prime-therapeutics-to-retain-humira-alongside-biosimilars-on-netresults-formulary-in-2023

17. Myshko D. OptumRx to cover Amgen’s biosimilar of Humira. Managed Healthcare Executive.November 18, 2022. Accessed March 10, 2023. https://www.managedhealthcareexecutive.com/view/optumrx-to-cover-amgen-s-biosimilar-of-humira

18. Tozzi J, Peebles A. Humira competitors have CVS wrestling with complex calculations. Bloomberg.January 6, 2023. Accessed March 10, 2023. https://www.bloomberg.com/news/articles/2023-01-06/abbvie-abbv-humira-biosimilars-require-complex-math-from-cvs

Articles in this issue

almost 3 years ago

Case Study: Treating Infants for Cannabis Exposurealmost 3 years ago

Oral Treatment Approved for Anemia Caused by CKDalmost 3 years ago

A Return to Normalcyalmost 3 years ago

Oncology Pharmacists Are Crucial in Skin Cancer Managementalmost 3 years ago

What Pharmacists Need to Know About Point-of-Care Testing for STIsalmost 3 years ago

The JAK Inhibitor Pipeline Builds in Dermatologyalmost 3 years ago

Kudos to WHOalmost 3 years ago

How Pharmacists Should Talk So Vaccine-Hesitant Parents Listenalmost 3 years ago

Safety, Accuracy of Dexcom G7 CGM Evaluated in T1D and T2DNewsletter

Pharmacy practice is always changing. Stay ahead of the curve with the Drug Topics newsletter and get the latest drug information, industry trends, and patient care tips.