Pulled COX-2 drug could face skeptical market

Drug manufacturers breathed a collective sigh of relief last month after a Food & Drug Administration advisory panel concluded, at the end of three days of hearings, that COX-2 inhibitors should be allowed to stay on the market. The panel urged strict limits on the drugs as a condition of their continued sale, reflecting a sense of unease among experts and many patients over whether the benefits are worth the risks. The committee's narrow approval allowing Vioxx (rofecoxib, Merck) back on pharmacy shelves also reflected the public's willingness to accept the drug after widespread media coverage of its potential for cardiovascular harm.

Drug manufacturers breathed a collective sigh of relief last month after a Food & Drug Administration advisory panel concluded, at the end of three days of hearings, that COX-2 inhibitors should be allowed to stay on the market. The panel urged strict limits on the drugs as a condition of their continued sale, reflecting a sense of unease among experts and many patients over whether the benefits are worth the risks. The committee's narrow approval allowing Vioxx (rofecoxib, Merck) back on pharmacy shelves also reflected the public's willingness to accept the drug after widespread media coverage of its potential for cardiovascular harm.

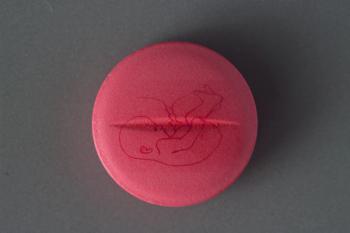

Panelists ultimately supported continuing sales of Bextra (valdecoxib, Pfizer) by a 17-13 vote (with two abstentions) and backed Vioxx's potential return to the market by 17-15. Celebrex (celecoxib, Pfizer), suggested by a handful of studies to be the least cardiotoxic of the available COX-2 drugs at lower doses, passed with a far less controversial vote of 31-1.

Vioxx has not been sold in U.S. pharmacies since Sept. 30, 2004, when Merck pulled it from the worldwide market following the disclosure of data showing that the drug more than doubled the risk of heart attack and stroke. Many experts sought to return COX-2 drugs from widespread "blockbuster" use to more limited prescribing among the patients for whom they were originally intended: those who get no benefit from traditional nonsteroidal anti-inflammatory drugs (NSAIDs) or who cannot tolerate their potential for causing gastric ulcers.

In an interview with Drug Topics, Winckler expressed concern that the FDA might issue separate risk-management orders for the three approved COX-2 drugs, adding to confusion and paperwork among R.Ph.s who already deal with dozens of sticker programs and patient guides for various medications. "As consistent as the risks are, let's have a consistent intervention," she urged.

At press time, APhA was also lobbying the FDA to use the COX-2 situation to change what Winckler suggested has been a haphazard approach to risk management and patient education in pharmacies. Regulators, she contended, should embark on studies of how different risk-management programs change patient and pharmacist behavior, instead of just "starting another sticker program." If they invested more in pharmacist/patient interaction, they would probably see greater results than with just seeing that a piece of paper gets handed out, she added. But is FDA showing any interest in broader risk management practices in pharmacies? "We're not necessarily optimistic," she said.

The committee gave broad backing to black-box warnings alerting consumers and health professionals to the increased risk of cardiovascular events associated with the drugs. It also supported the use of patient-oriented medication guides, a ban on direct-to-consumer advertising, and possible new education programs designed to apprise physicians of the drugs' risks.

At press time, the FDA had not yet acted on the group's recommendations, but officials said at the close of the hearings that they would issue decisions in a matter of weeks. John Jenkins, director of the agency's Office of New Drugs, told reporters that he interpreted the panel's votes as saying that "these agents should perhaps not be as widely used."

Merck officials surprised many at the meeting by suggesting that it could move to bring Vioxx back to U.S. pharmacies. Pfizer has announced no plans to curtail sales of Bextra or Celebrex. The panel also urged FDA to consider warning labels on an unspecified number of older NSAIDs, citing a scarcity of evidence refuting concerns over cardiovascular risk. Even assuming FDA acts on the panel's recommendations, the drugs are likely to confront resistance from skeptical patients and physicians, a pharmaceutical market researcher said.

Only 31% of consumers and 22% of physicians in a recent poll rated chronic pain medications as safe drug options. Patients ranked the drugs eighth out of 11 therapeutic classes in terms of their perceived safety, while doctors put them at the bottom of the list.

"The entire therapeutic class has a significant perception problem," said Brad Fay, managing director of NOP World, a company that conducts market research for drug companies. Media coverage and safety concerns surrounding arthritis drugs appear to have also damaged the public's perception of health professionals and regulators, Fay said.

Just 36% of 1,000 consumers polled by NOP said FDA was doing a good or excellent job at protecting the public from unsafe drugs, while pharmaceutical companies fared only slightly better at 40%. Fifty-three percent said physicians were doing a good job.

Meanwhile, retail pharmacists topped the list with a 56% public approval rating on drug safety. But Fay also issued a word of caution. "When the President's excellent/good job approval ratings are around 50%, people around him are worried."

Newsletter

Pharmacy practice is always changing. Stay ahead of the curve with the Drug Topics newsletter and get the latest drug information, industry trends, and patient care tips.